Making sense of today’s real estate market

“What the heck is happening in the real estate market?” “Is it still hot?” “Are prices falling?” “Is this a good time to buy?” “Is this a good time to sell?” Most days, we get some combination of these questions, so we thought it might be helpful to break it down in simple terms. First, if you’re paying attention to the news, you might think the sky is falling! Take a breath, Chicken Little. The sky is NOT falling, and this is definitely not 2008 all over again. But there are some economic factors that everyone should be aware of that are most certainly contributing to the current state of the real estate market. There are also some steps you can take to ensure you’re making the best decisions for your financial health.

Interest rates

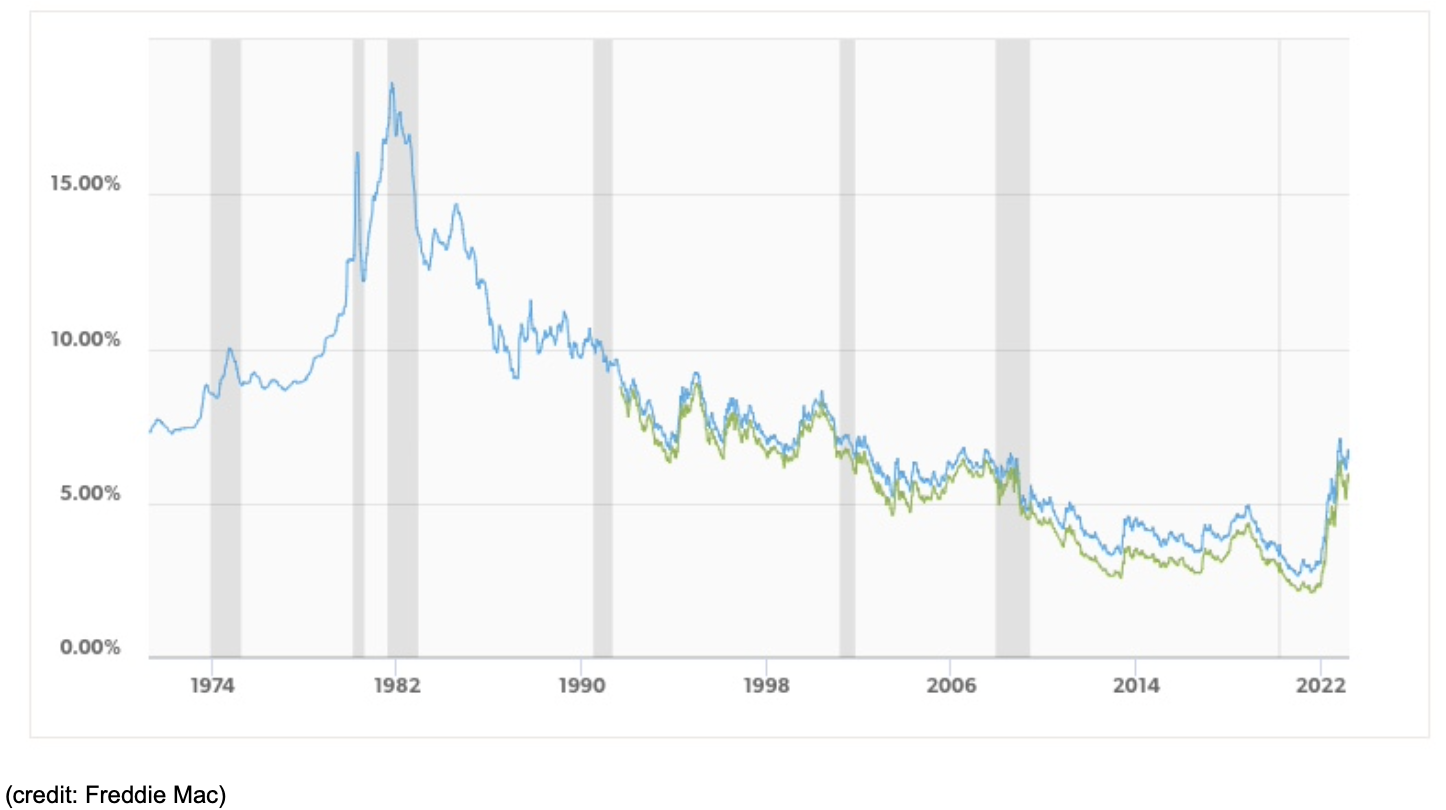

The first factor to understand is interest rates. The cost of a mortgage payment is primarily driven by 3 things - the loan amount, the term (i.e. 20 years, 30 years, etc…), and the interest rate on that loan. For the past dozen or so years, interest rates have remained incredibly low at under 5%, dipping to historical lows of under 3% during 2020-2021. That was amazing for homeowners, helping to balance the high price of homes with a lower interest rate, increasing overall affordability. When interest rates began increasing in 2022, specifically with the radical action of the Fed in its attempt to curb inflation, interest rates became a negative factor for affordability. In a very short period of time, the overall cost of purchasing a home (or anything, for that matter!) rose significantly while prices remained steady.

Available inventory

In King County, the number of new listings hit a low in December 2022. Low inventory is not a new story for the Greater Seattle area. For years, our demand has outpaced supply, adding to the rapid rise in home values. That said, the December 2022 dip came on the heels of the interest rate spike, causing more homeowners to stay a little longer in their cozy 3% mortgage rates, when they otherwise might have been selling to right-size or relocate. It stands to reason that the interest rate hikes not only affect affordability for new buyers, but also the likelihood of a current owner selling and giving up their great rate. The challenge is that this is a self-fulfilling cycle. We have a number of would-be home sellers, willing to make the move now and add their homes to the list of much-needed housing inventory… they just need to find the right house first in this low-inventory market. See the problem?

Home prices

The topic of home prices is always one that requires interpretation. Home prices are very specific to the micro-market. In areas where the inventory is still incredibly low, we’re seeing home prices holding steady or even slightly increasing. We have neighborhoods in Seattle where multiple offers and price escalations are still the norm, and others that are feeling a small dip in value. In general, a hot house is still a hot house – the more appealing the house is to a broad set of buyers, the higher the chance is that it will escalate in price. The bottom line is that you cannot take the current headlines at face value and apply them across the board, at least not in Seattle. If you’re planning to purchase, we’ll put together a strategy for the specific home, in the specific neighborhood, based on your personal situation and the overall circumstances of the home for sale.

So… what do we do with all this information?

First, know that homeownership is almost always a great bet for your long-term personal wealth. Home values may rise or fall over the short term, but over every 10-year period since the beginning of time, values have risen. If you’re in it for the long haul, it doesn’t matter if we’re at the top of the market or the bottom, it will still rise over time. Remember 2007? Right at the top of the market before it crashed? We wish we had purchased 5 houses then. Homeownership wins the long game.

Throughout history, interest rates also rise and fall, but they are temporary. What’s crazy is that these new “super high” rates are actually relatively tame, historically speaking. Refer back to the interest rate graph above. Back in the 80’s rates rose to over 18% and people still found ways to buy homes. What many people don’t realize is that the mortgage industry has done a fantastic job of coming up with new loan products to make mortgages more affordable. Rate buydowns, adjustable rates, and other specialty products can significantly reduce the impact of these higher rates. Be sure you’re dealing with real people when determining the best mortgage product for you. Online banking sites are fine for getting a general idea, but you’ll want an actual loan specialist to analyze your situation and help you find the best solution to protect your finances. We’re always happy to refer you to one of our trusted lenders to make homeownership more affordable for you.

Last words of advice: as soon as you start thinking about buying or selling, contact us for an in-depth consultation. There are many ways to approach this market and we’ll help you strategize the best plan for you and the specific conditions of the market. We know there is uncertainty so we’re doubling down on our education and market knowledge to make sure we’re ready for all of it. We got you!